JFSA Reporting Solution

Derivatives trade reporting was first introduced in Japan in 2012. Since then, reporting requirements for OTC derivatives has been mandated for a number of financial institutions, including type-one FIBO, registered banks, insurance companies and certain financial institutions designed under the OTC derivatives ordinance 21. Transactions are currently mandated to be reported on a weekly basis.

In 2015, CPMI-ISOCO published a consultation paper and provided guidance in terms of how reporting of OTC derivatives should be standardized. From there, we have witnessed several G20 regulators having published their own version of the consultation papers adapted for their local market. More recently, the JFSA is releasing an updated version of its reporting regulation. Expanding to 139 data element fields, the update is currently scheduled to go live in April 2024.

The new version aims to harmonize JFSA reporting to global reporting standards and will be challenging to the industry as changes will occur on multiple fronts. Example of the changes expected include reporting frequency, required data points, reporting to a trade repository instead of directly to JFSA and many more.

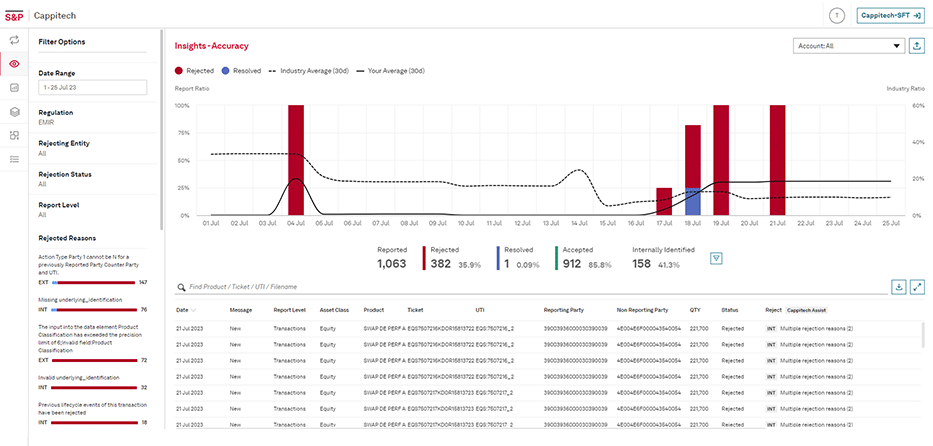

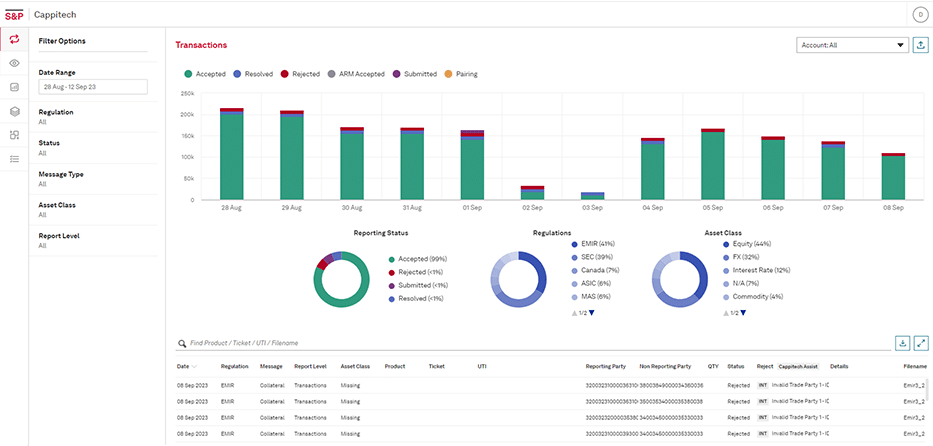

Cappitech specializes in preparing firms for new and changing regulatory reporting obligations. We can help you with the upcoming JFSA reporting changes and provide you with the peace of mind you need, knowing our solution is trusted by over 550 customers around the world.

How Cappitech can solve your reporting obligations

What is JFSA reporting?

Post the Great Financial Crisis in 2009, Dodd-Frank was first introduced as one of the largest and most comprehensive financial regulations. One of the main objectives was to restore public confidence and to prevent another financial crisis from occurring.

Regulators around the world have introduced its version of financial regulation in the OTC space. Since Nov 2012, Japanese FSA has introduced mandatory reporting of OTC derivative on a weekly basis.

Which financial institutions are in scope for JFSA reporting?

A few types of financial entities, like licensed banks and insurance companies are mandated to start reporting their transactions since 2012.

Where are products need to be reported under JFSA?

All swaps across Interest Rates, Credit, Equity and, FX derivatives.

When does JFSA rules rewrite come into effect?

CPMI-ISOCO harmonization of reporting standards was aimed to commence late 2022. Each regulator may have their own timeline around that targeted commencement period.

Learn More