What is ESMA doing with collected data? EMIR, SFTR, MIFIR Data Quality Report Sheds Answers

For those in the transaction reporting business, one of the highlights of regulatory information is ESMA’s annual data quality report. Starting with just EMIR in 2021, the report expanded to include analysis of SFTR last year, with MIFIR information being added this time around.

In the EMIR, SFTR, MIFIR Data Quality Report released two weeks ago (link), ESMA provided an update of what their analysis revealed as well as describe their “new strategic approach” for how they monitor and share the information with NCAs. ESMA explained that to improve efficiency and standardize how data is reviewed, they have created a dashboard system that monitors 19 indicators. The dashboards are then made available to NCAs for them to keep breast of overall statistics as well as provide benchmarking to figures when reviewing data from individual submitting firms.

The indicators cover under/over reporting, inconsistent reporting and incomplete reporting. It also reviews for late submissions, anomalies in data and lack of clarity between counterparties. Understanding what these indicators are and how regulators are reviewing information, allows firms to have a better grasp of how to monitor their own submissions for potential issues.

According to ESMA, since the first release of the first data quality report in 2021 (more on this report), they have seen an improvement of data quality of the submissions. They attributed this to a combined effort of NCAs making firms aware of issues as well as companies putting in place better processes to monitor their submissions.

Key EMIR/SFTR findings covered by ESMA

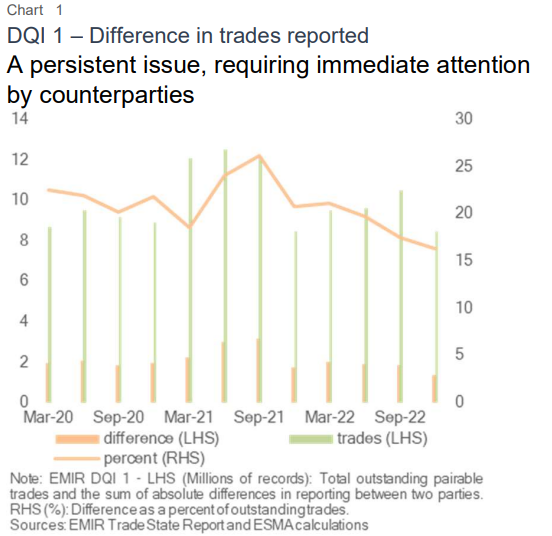

Differences in reported trades/positions between counterparties: One of ESMA’s checks covers the number of reported trades and positions between counterparties. The gaps are due primarily to cases where one firm isn’t reporting their side of the trade, a position that was terminated by one send remains open by the other counterparty and differences where of whether firms are reporting in Position versus Trade level. ESMA displayed that there were positive trends in the data as differences in reported trades that peaked at 26.1% in September 2021 had fallen throughout 2022 and reached comfortably below 20% (see chart).

Alignment of reported data between counterparties was also highlighted in ESMA’s Final Report of their REFIT Guidelines. The paper requires firms to unify their approach to reporting open trades in one of the Position or Trade Level format. Also, ESMA described how the trade state reports (TSR) and post submission pairing and matching information provided by trade repositories (TRs) can be used to reconcile breaks and spot data problems (more on this subject here).

Late Valuations: One area of focus in previous reports has been late valuations. These are open positions where the latest valuation was over a month old. This can be due to a reporting entity failing to report an Early Termination message on a closed position, or an error with their procedures to submit updated valuations on open positions. Since highlighting the problem in 2021, the percentage of positions with late valuations has decreased dramatically, having reached a low in 2022 of 13.2% after being as high as 38.2% in the past.

Abnormal Maturities: In their 2022 report, ESMA explained that part of their review initiatives was reviewing for abnormalities of submitted data in fields with numeric values (see last year’s report). One of the fields found to have sustained abnormal data is the Maturity field where maturities of above 50 years or missing data has consistently accounted for 10-16% of reports (see chart). ESMA explained that without improvement in this area, NCAs will begin to conduct contacting reporting entities about the issue.

Abnormal Maturities: In their 2022 report, ESMA explained that part of their review initiatives was reviewing for abnormalities of submitted data in fields with numeric values (see last year’s report). One of the fields found to have sustained abnormal data is the Maturity field where maturities of above 50 years or missing data has consistently accounted for 10-16% of reports (see chart). ESMA explained that without improvement in this area, NCAs will begin to conduct contacting reporting entities about the issue.

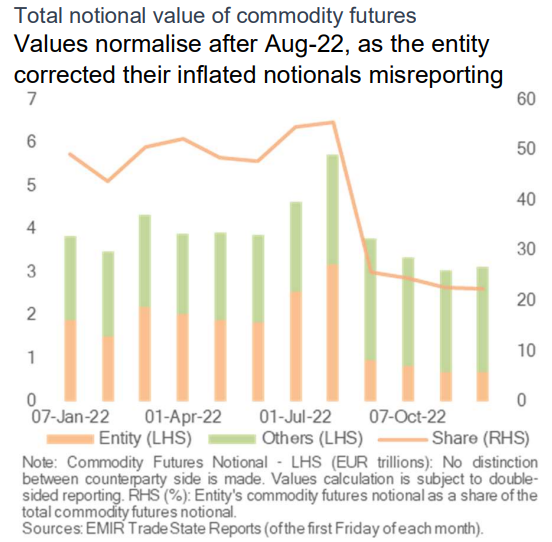

Overall Notional Values: One of the more interesting indicators that ESMA shared was its review of overall total notional reported values of all contracts. By reviewing month over month changes, ESMA spotted a spike higher in total notional values which led them to dive deeper into the data and discover a single entity was reporting notional and quantity values incorrectly. The issue was shared with the entity’s local NCA which communicated with them about solving the issue. The increase and subsequent decrease in total notional commodity values is reflected in this chart. Overall, this instance revealed one of the methods that ESMA is able to review for incorrect data within accepted submission data.

Inflated Loan Values: Similar to the above analysis on notional values under EMIR, ESMA also reviewed SFTR loan values for irregularities. When analyzing the largest 20 loan records, their analysis uncovered incorrectly reported loans among three entities. Upon being contacted by the NCA, the issue was rectified with overall loan values dropping to normal amounts.

Trade Repository analysis: Part of ESMA’s review includes monitoring the work of the licensed Trade Repositories (TR). In regards to SFTR, ESMA stated that they were involved with ensuring the wind-down of the UnaVista (read more) and porting of data to other TRs by January 2022 operated efficiently. They also did analysis between Trade Activity Reports (TAR) of submissions and aggregated Trade State Reports (TSR) generated by TRs to ensure TAR data was being correctly reflected in the TSR. Overall, ESMA found TRs were processing information as per their mandates with a few issues of errors and inconsistencies brought to their attention.

No Pairing & Matching Coverage: Notably absent was an update of pairing and matching statistics for EMIR and SFTR submissions. These are the percentage of submissions where the same UTI was correctly used between both counterparties. Covered in their 2021 and 2022 reports, ESMA had found UTI pairing to be improving for EMIR, but stalling out at around 60%. The lack of mention in this year’s report could indicate that ESMA believes the pairing issues are well understood within the regulatory reporting industry and don’t require further analysis.