SEC 10c-1a Update: FINRA Draft Specifications released with information on how to submit to SLATE

Following SEC approval earlier this year, FINRA has released its much awaited second draft specifications for the Securities Lending and Transparency Engine (SLATE™) which is the system by FINRA to ingest and disseminate securities loan transaction data related to CAT*, TRACE** and RTRS*** reportable securities. SLATE will provide feedback on receipt of these reports indicating whether they have been accepted or rejected. The specification document provides more clarity on how participants should report securities loan transaction data and is crucial for implementation, testing and execution.

Here are some of the key points of the specifications

System hours

SLATE will be available for reporting between 6:00:00 a.m. and 11:59:59 p.m. Eastern Time.

- Loan events reported after the system closes will be rejected and must be reported the next business day.

- Loan events before 7:00:00 p.m. on a business date (Day T) must be reported the same day before the system closes. Loan events reported after this time on a subsequent business day (T+n) will be considered late

- Loan events after 7:00:00 p.m. are not due until the next business date

- Loan Events effected on a non-business day (Saturday, Sunday, Holiday or a date SLATE is not open at any time during the day), must be reported on the next business day during System Hours.

Key Data Elements

- Client Unique Loan ID (clientUniqueLoanId): This is the Covered Person’s unique identifier for a loan, required for New and Pre-existing Loan Modification Events. It must be unique for the New Loan Event’s Event Date and the date the event was reported.

- FINRA Loan ID (FINRALoanId): The system assigns this ID to each unique accepted loan. It is required for all subsequent modifications, deletions and terminations if the corresponding New Loan Event or Pre-existing Loan Modification Event was submitted on a prior day.

- FINRA Control Number (parentFINRAControlNumber): The system assigns this unique identifier for each individual loan event reported to SLATE. It is used for correcting or cancelling a previously reported event and is required on Cancels and Corrections the day after it was originally reported (R+n).

- Record Identifiers (fileRecordId): This is new field which is used to sequence all the events within a reported filed, any duplications will be rejected. The fileRecordId must be referenced by populating the parentFileRecordId for all corrections or cancellations on the same day (R0) where a FINRA Control Number has not been assigned.

General Event Reporting

The different message / report types have been split into two categories:

- Loan Event which includes New, PreExisting, Modification & Termination event types

- Data Editing which includes Correction, Cancel & Delete event types

In terms of reporting modification and correction events, further clarity has been given in how they should be reported.

- Modification Events: Other than key fields required for linkage and the date and time of the modification, reporters must only send the modified fields that are required to be submitted.

- Correction Events: Other than key fields required for linkage, reporters must only submit the updated fields that are required to be submitted

How to link previously reported events with the different elements

- There is an updated event linkage table which details which elements should be used to link previous events depending on the message type and reporting day with the introduction of “fileRecordId”

The Include Key table has been updated with further specificity and a new data element

- Optional – additional clarification provided (should be reported where applicable)

- Voluntary – new value introduced (can be reported, but will not be disseminated)

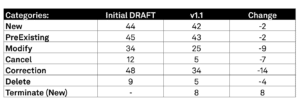

At a high level, the changes to the reporting specifications from the Initial DRAFT to version 1.1, can be summarized in the below table which shows the before and now of the number of data elements.

As we continue to analyze the SLATE requirements, further questions and new revelations will arise. Although the extension to the implementation guidelines may not be immediately clear, it is crucial to begin preparations now. For more information about how we can help you prepare for the SEC 10C-1a, please contact us here.

*Consolidated Audit Trail ** Trade Reporting and Compliance Engine *** Real-time Transaction Reporting System