MiFID II Transaction Reporting

Our innovative solution reduces your reporting headaches and errors while lowering the costs of MiFID II compliance. Ever since MiFID II regulation came into effect in January 2018, banks, investment managers and brokers face new, complicated regulation reporting requirements, at a hefty expense.

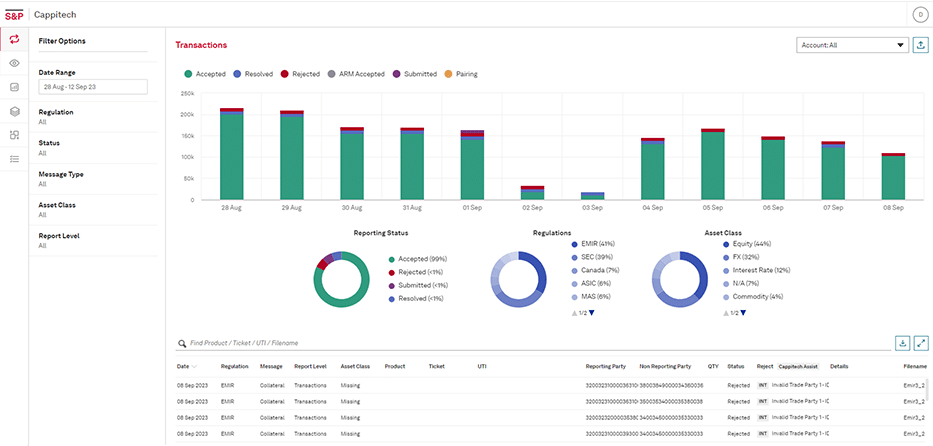

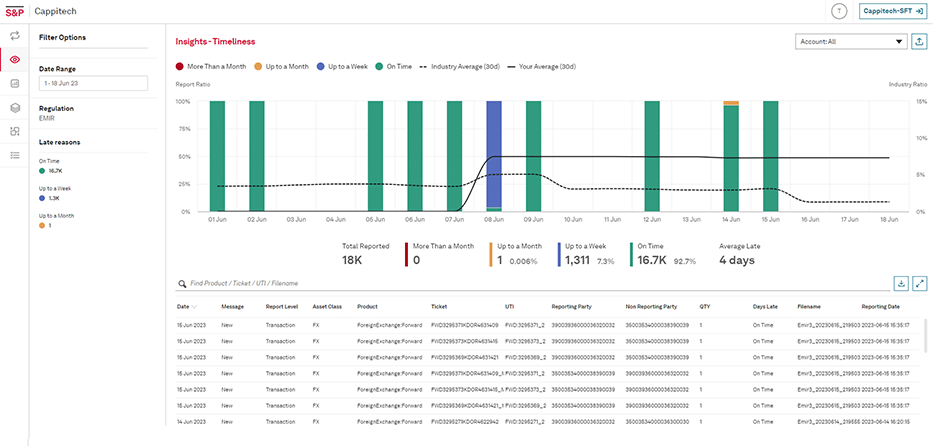

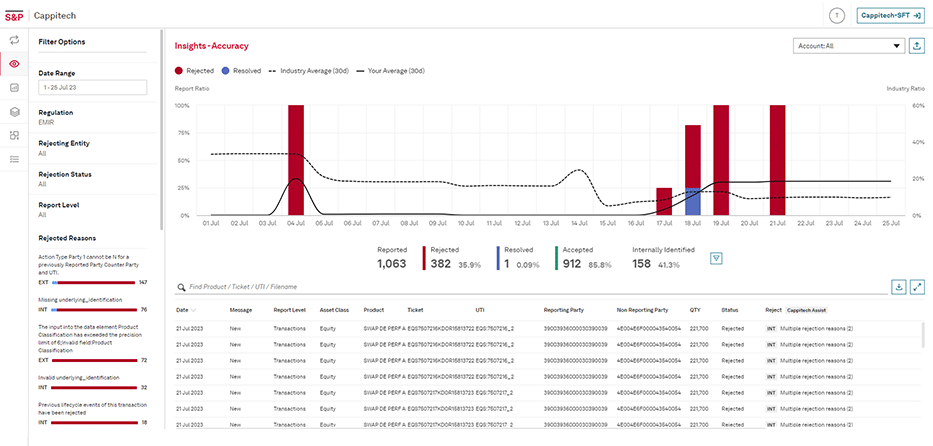

We offer full MiFID II compliance from its own proprietary, secured and automated, platform, as well as providing instant insights based on trading data. The platform seamlessly integrates with your trade reports from various systems including EMS and OMSs. Data is compiled and submitted to an ESMA licensed ARM allowing you a smoother, more thorough MiFID II compliance for regulation by all European NCA’s (including FCA, BAFIN, CySEC, CBOI, MFSA)

How Cappitech can solve your MiFIR reporting obligations

What is MiFID II?

MIFID II started in 2018 and is an update from MIFID I that came into effect in 2007. As the legal documents for MIFID II where nearly four times as long as MIFID I, the regulation was split into two frameworks: MIFID and MIFIR. MIFIR deals with reporting obligations and MIFID deals with corporate governance issues. For clarity, we refer to both MIFID and MIFIR as MIFID II.

Who needs to report MiFID II?

EU investment firms with a MiFID Investment Firm license designation are required to report under MiFIR. Exemptions exist for firms with a AIFM or UCITS license that also provide MIFID Investment services but that is not their main source of business.

Where are trades reported to under MiFID?

Under MIFID II, transaction reports are submitted to a National Competent Authority (NCA). This is the firm’s local regulator. For example, the FCA is the NCA in the UK and BAFIN is the NCA in Germany.

In addition, firms can decide to send the report to an Approved Reporting Mechanism (ARM) who then shares it with the NCA.

Why use an ARM for MiFID II transaction reporting?

The advantage of an ARM compared to sending directly to the NCA are additional validations the ARM can do to reduce errors received by the NCA. Also, for firms that have entities in different parts of Europe, for example a UK and Cyprus entity, we can send the reports to single ARM who splits it to the different NCAs.

Learn More