Data Harmonization and Regulatory Reporting – The Holy Grail?

2021 is already shaping up to be a transformative year for regulatory trade and transaction reporting. With Dodd-Frank reporting hitting the eight-year anniversary this year and EMIR seven, as an industry, we have come a long way. Our collective understanding of the regulations, validation rules, operational processes, controls, governance, and technology has vastly improved over the last several years, but one key piece eludes us still, data harmonization.

The Oxford dictionary defines harmonization as “the process of making systems or rules similar in different countries or organizations”, but what does it mean in the context of regulatory trade and transaction reporting, and why is it so important?

In its most basic form, a trade should be represented in a single, unified and consistent way, regardless whether it was traded in London, New York, or Hong Kong.

However, still so often, the same trade can be reported in multiple jurisdictions with different timing, definitions, trade identifiers, presenting similar fields at first sight, however populated with different logic.

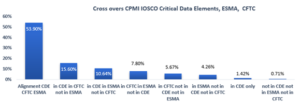

Looking at the cross overs between ‘CDE’ fields for the CFTC Rewrite, SEC SBSR and EMIR REFIT to quantify what harmonization meant in practical terms around data field and technical reporting requirements, there were only 54 ‘CDE’ fields which were fully aligned, the cross-over reaches 54% with 76 fields when adding partially aligned fields (such as with same definition but format or values or logic differences). Even when definitions or interpretations align, when one drills into the details, subtle differences emerge such as for execution timestamp which looks similar at first sight but there is an additional requirement on position reporting for EMIR.

Although most market participants could agree with the benefits of harmonization, operational practicalities present challenges, where striking a balance between the expected longer term benefits and the immediate burden to invest in standardization will require an industry-wide buy-in to move to the ‘implementation’ stage with the burden of Business As Usual (BAU) taking priority in the short term.

Below are some examples illustrating challenges with harmonization as it relates to the practical application of the rules

Similar fields could present different interpretations across jurisdictions, such as valuation amounts reported with or without adjustments, notional schedules approaches differing for step-up swaps, packaged trades reporting potentially varying between CFTC and EMIR with the same transaction considered a single structured trade for one jurisdiction and not necessarily for the other despite both of them having implemented CDE guidance[1].

- Some uncertainties remain around the implementation of standards for Identification of financial instruments such as the Unique Product Identifier (‘UPI’) to identify OTC derivatives neither admitted to trading nor traded on a venue or via a systematic internalizer: having two standards for financial instruments UPI and International Securities Identification Numbers (ISINs) may lead to additional build complexity.

- Life cycle events were not included in the standardized CDE elements given their complexity. Different interpretations could be adopted across jurisdictions, such as when related to the Risk Free Rate (RFR) transition, for instance. This could present an issue for cross jurisdictional transactions which follow CPMI IOSCO UTI decision tree.

It should be noted that when a field is missing within a jurisdiction rule, it could happen that alignment would still occur through the Trade Repository fields or the ISO XML schema (e.g. ‘executing agent’/ ‘investment manager’ or ‘price’ and ‘price notation’ fields). The works on the ‘Derivatives SubSEG’ group for the CFTC Rewrite and EMIR REFIT ISO schema are key.

To be clear, global regulators have made tremendous strides in working towards harmonized requirements. International bodies such as Global Legal Entity Identifier Foundation (GLEIF), the Association of National Numbering Agencies Derivatives Service Bureau (ANNA DSB) [2] or the ISO standards Technical Committees have played a crucial part in that endeavor along with the trade associations.

Some early fruits are beginning to bear as shown by encouraging metrics presented by GLEIF for the progression of LEI adoption. Public/ private strategic initiatives are showing great dynamism such as UK Digital Regulatory Reporting initiative[3] or the European Financial Data Space[4] spearheaded by the European Commission fostering the development of global data standards such as ISO[5], standardized digital rules, events, data models (Common Data Model) [6]. Harmonization has to be supported by appropriate technology and digital strategy.

CFTC is pushing to align with other jurisdictions: the requirement to identify swaps using unique transaction identifiers (“UTIs”) in lieu of the existing unique swap identifier (“USI”) aligned CFTC rules with international CPMI-IOSCO recommendations. For the first time, CFTC is also now including 15 additional fields on collateral and margin data elements, reporting deadline is extended to T+1 for Swap Dealers) and over three quarter of the 128 fields are sourced from CPMI IOSCO CDE.

ESMA has sought further consistency across reporting regimes (EMIR, SFTR, MAR, MIFID, Benchmark Regulation) as shown in the Final Report of MIFIR review[7], especially on reference data with ESMA securities hub being used across MIFIR reference data reporting and transparency calculations, or on counterparty data, such as for issuer Legal Entity Identifiers or ‘Investment Manager’/‘Executing Agent’ identification requirement.

The pace of new regulations is indeed slowing, more time is provided for testing and implementation based on previous regulatory go-live experiences, however, the changes to regulations, mainly driven by the quest for data quality, has not slowed. And this pace of changes is running much faster than the global harmonization ship is being steered, which ultimately creates many unknows for market participants.

There is clear merit and benefit to moving the industry to a standardized format, but it could be challenging for those standards to be in place in a coordinated way with a sufficient lead time before implementation. This could ultimately kick the harmonization can down the road with staged and back and forth for rebuild.

Market participants will need to keep a close eye on the data harmonization efforts and incorporate them into their strategic reporting solutions. One way to ensure that firms are keeping pace with constant change is partnering with industry solution and data providers. IHS Markit has been a part of the derivatives and securities financing ecosystem for over 10 years and has been an industry leader in trade processing and reporting across various asset classes.

Full data harmonization may look like a holy grail however the path that leads to that ideal goal is as important as the ultimate objective, the key here is a willingness by all parties of the reporting eco system to cooperate and converge as much as feasible, and this means a willingness to dive into the details and link technology, business processes and regulatory requirements.

Download the full Data Harmonization and Regulatory Reporting report by Que-Phuong Dufournet-Tran, Director Trading Services & Analytics, Regulatory Affairs, IHS Markit, and Igor Kaplun, Executive Director, Head of North America, Business Development, IHS Markit

For more information, please contact us here.

—————————————————-

[1] Common Data Element (CDE) guidance the CDE states that a package “may include reportable and non-reportable transactions”, but this is not specified within the EMIR RTS

[2] https://www.anna-dsb.com/

[3] https://www.bankofengland.co.uk/paper/2021/transforming-data-collection-from-the-uk-financial-sector-a-plan-for-2021-and-beyond

[4] https://ec.europa.eu/info/strategy/priorities-2019-2024/europe-fit-digital-age/european-data-strategy_en

[5] https://www.iso20022.org/financial-repository

[6] https://www.isda.org/2018/11/22/isda-cdm-factsheet/

[7] https://www.esma.europa.eu/press-news/esma-news/esma-proposes-amendments-mifir-transactions-and-reference-data-reporting