ESMA EMIR Report Shows Pairing & Matching Continue to be Low but Valuation Errors Improve

ESMA was in a serious mood on April fools’ day as they used the first of the month to publish their 2021 EMIR and SFTR data quality report. The annual report covers analysis from their Data Quality Action Plan (DQAP) under EMIR and the Data Quality Engagement Framework (DQEF) under SFTR.

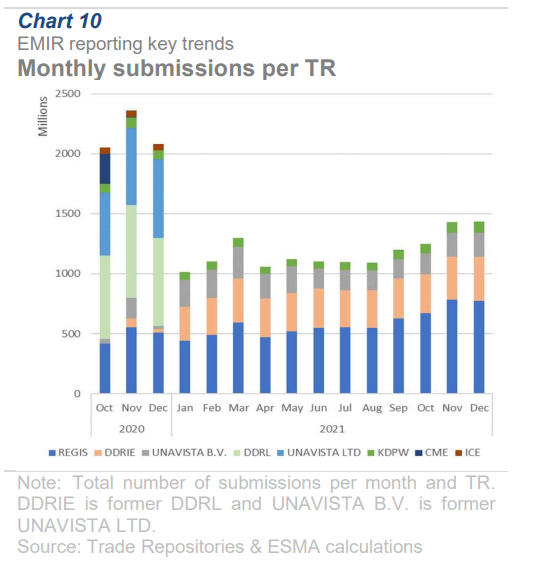

Focusing on EMIR, in today’s blog we take a look at key points raised by ESMA in their EMIR analysis (keep an eye out for the SFTR review post later this month). According to ESMA, their review focused on 30 data quality aspects including the important aspects of Completeness, Accuracy, and Timeliness (learn more about CAT). The data took into account changes due to Brexit with overall submissions to trade repositories (TR) declining by 50% compared to last year. The removal of UK firms under ESMA scope also reduced non-reporting figures to below 5%.

Trade Repository stats

In addition to lower non-reporting stats, data collected from TRs revealed that rejection rates remained low at around 2%. TRs also reported negligible rates of duplicate reporting taking place.

The ESMA review also monitored the status of how TRs were ingesting and sharing data. Overall, repository processes and systems were found to be working well. In a review of how TRs ingest data, 20 million sample submissions were sent with limited errors found and primarily were focused on incorrect modifications of counterparty data.

ESMA also reviewed the quality of data being shared by TRs to NCAs. While ESMA didn’t find structural problems in the data sharing, they did reveal numerous cases of over and under reporting of information to TRs.

Overall, TR stats showed that Regis continued to hold its strong position as it was the largest benefiter in terms of new submissions following the closure of the CME Trade Repository in 2020. For 2021, Regis led all TRs in monthly submissions (see chart above), followed by the DTCC.

In a review of 20 million sample submissions to trade repositories, ESMA found limited errors on data ingestion by the TRs. Errors that were found were focused on incorrect modifications of counterparty data.

Valuation improvement

One of the improvements highlighted by ESMA was the improvement in misreporting of valuations. According to the report, the number of firms with valuations misreported where the valuation field was empty was reduced by 50% compared to 2020. ESMA attributed this reduction on NCA monitoring and raising the issue with reporting firms.

Another area of focus in 2020 that saw improvement were ‘stale’ position. These are open positions where there wasn’t a new valuation update submitted for them in over 15 days. While improvements took place over the year, 2021 ended with only 80% of open position having a valuation update less 15 or less days old. Similar to 2020’s ESMA review, there were was a concentration of countries where stale valuations taking place. For example, only around 10% of positions by Bulgarian firms had a valuation update less than 15 days old. This could indicate systematic problems for a small number of high volume firms where derivatives aren’t being terminated at the TR level when they are closed.

Timeliness

ESMA found that late reporting continues to be a problem with a little less than 10% of submissions not meeting the T+1 requirement. Similar to the above valuation updates, certain countries had greater problems with late reporting compared to others. The data showed that about 45-50% of submissions from Netherlands and Portuguese firms were reported late. This compares to less than 10% from German submissions.

Pairing & Matching

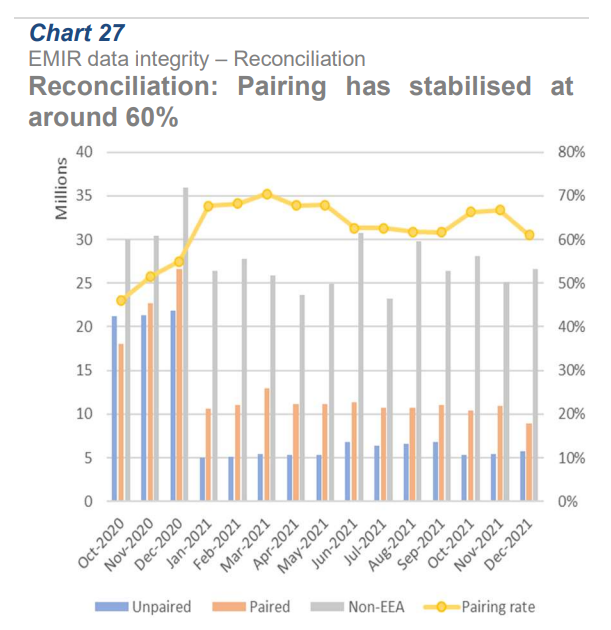

Pairing rates pre-Brexit were below 50% but have stabilized at around 60% (see chart). The figures are based on a light reconciliation comparison, with only Counterparty ID 1&2 and UTI used for the pairing confirmation. The data also showed about a 5% difference between open positions reported between counterparties. This could allude to different formats on how reporting firms are netting trades and reporting positions.

ESMA sees the 60% pairing rate as something that needs improvement. The report suggested that the low rates are due to a lack of agreements between parties to share UTIs, under/over reporting between counterparties and incorrect identification of counterparties.

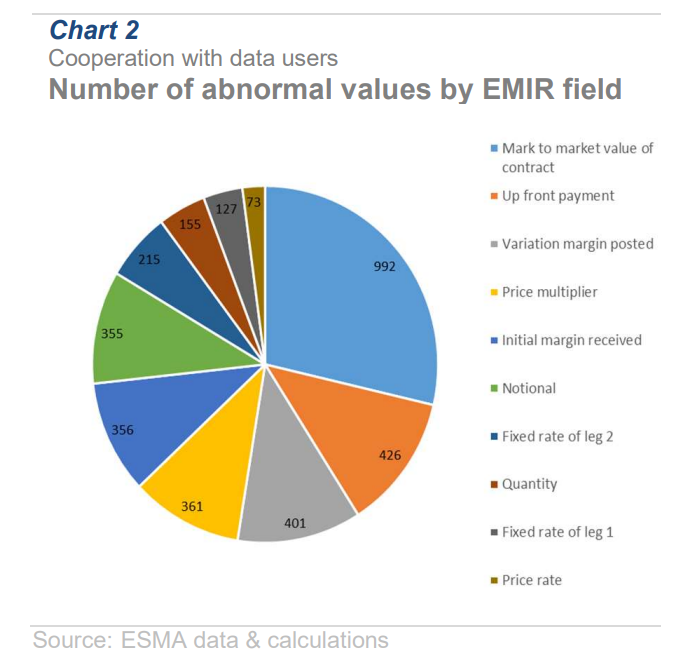

Finding Anomalies

As part of the DQAP under EMIR, ESMA created a filter to monitor for abnormal values in submitted reports. To do this, for numerical fields they created a range of high and low expected values. Trade data is then compared against these ranges to find values that are beyond these tolerances, to spot values for fields such as margins, value of contract, notional values, price, fixed rates and quantities that appear abnormal (see chart below). The data is then provided to NCAs to investigate more in-depth and when needed, approach reporting firms for more information.

Often when such submission abnormal values are found, they are the result of data capture or multiplier issues in a firm’s reporting process. Examples include cases where contract or price multipliers aren’t being contracted correctly, or interest rates are shown on a basis point instead of percentage basis.

It is worth noting that in client checks shared with S&P, we have seen an increase in NCA queries related to these abnormal numerical value reviews. Specific NCAs using the data have been CySEC and the MFSA.