FXCM on the Offensive, MiFID II Looms and CME FX Futures Improving

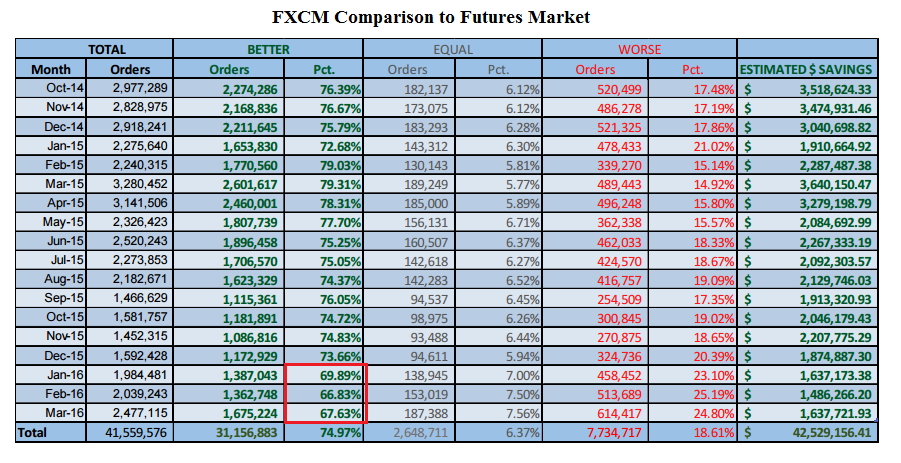

FXCM has recently issued their execution quality paper again. First published in February of this year with data from October 2014 to August 2015 comparing their pricing compared to FX futures and the interbank market, the new research updates the report through March 2016.

With the report, FXCM is trying to show the market and regulators that pricing for FX available to their customers is better than exchange listed futures as well as what institutional players have. One can argue that the figures are a bit misleading as FXCM’s pricing is specific to regions where they cut their spreads as part of wide ranging change they made in 2014. In addition, institutional and futures volumes offer larger top of book market depth, thus not an apple to apples comparison with FXCM.

Nonetheless, the figures do show what many in the retail market have known for a while, that retail traders have access to very tight pricing. (There is the issue of excessive slippage and scamming that exists, but that is more of a subjective argument against retail FX)

MiFID II and Best Execution

What’s interesting about what FXCM is doing is that it’s most likely the first of many similar reports from brokers. We are currently seeing regulators become more proactive with enforcing client abuse rules from MiFID I (especially yesterday).

With MiFID II arriving in 2018, it will move ahead the subjective debate of what is client abuse and best interests of customers that is governed by MiFID I, and create requirements for objective surveillance of broker execution quality.

Along with new reporting requirements, brokers will also need to be transparent about their pricing and execution process and how it compares to benchmarks. There is currently debate as to who will be creating and maintaining those benchmarks. ESMA even indicated that the delay of implementation of MiFID II from January 2017 to 2018 is partially to blame on them needing more time to put market data surveillance infrastructure in place.

The bottom line is that the process initiated by FXCM will undoubtedly be similar to execution transparency actions put in place by other broker regulated in the UK and EU. The formats for the research may become even more descriptive, with customers able to look up whether specific trades were executed around benchmarks pricing.

As we get closer to MiFID II adoption, how financial firms will deal with execution transparency is expected to get more attention. Specifically, handling the costs involves with maintaining market data and distributing reports will become a major headache for smaller and larger firms alike.

FX Futures Look Good

On the topic of FX pricing, futures execution quality appears to be improving in 2016. While three months isn’t necessarily enough data to make concreate assumptions, the figures from FXCM show an interesting trend.

After FXCM pricing was 72.68% or better than FX futures available on the CME during 2015, that figure dropped to about 68% for the first three months in 2016 (see chart above). During the same time, FXCM pricing was more or less the same when compared to interbank rates, which displays the change wasn’t due to worse rates distributed by FXCM.

It’s too early to provide explanations of what may behind the improvement in futures. But, it’s worth keeping an eye on, especially as prime brokers are cutting clients and access to FX ECNS, and hedge funds and asset managers look for replacements.