Preparing For EMIR REFIT – The New Direction Fields Format

Last month S&P Global Market Intelligence Cappitech launched its EMIR REFIT preparing series. As we get closer to EMIR’s new technical standards that are set to go-live on 29 April 2024, we’ll be spotlighting each month a different area of the update. In this month’s blog, we look at the new format for the direction field.

Say Goodbye to Buy/Sell and Hello to Payer/Receiver

One of the ongoing debates of global derivative transaction reporting such as EMIR, is how to account for the direction field of multi-leg products such as swaps and currency forwards. Rather than simply having a buyer and seller, each counterparty is paying out and receiving a leg of the transaction. To fit these products into the regulation, certain standards have been created to decide which counterparty is the buyer or seller. For foreign exchange swaps and forwards, the buyer is recognized as the counterparty receiving the currency that comes up first when sorted alphabetically. For interest rate swaps, the firm paying the fixed rate leg is defined as the buyer.

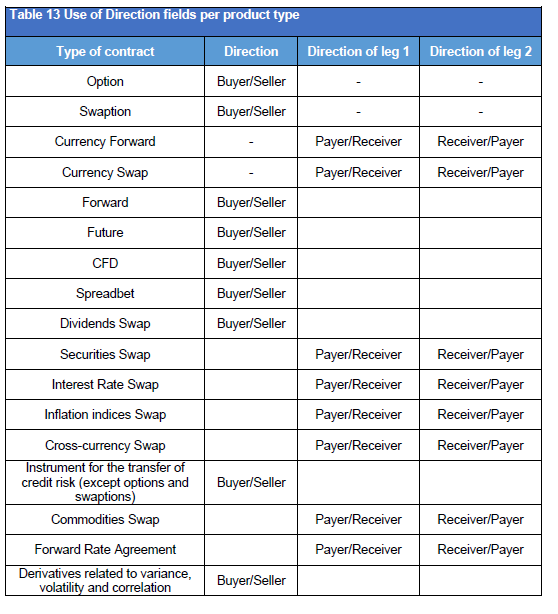

While these formats fit the swaps and other two legged products within the regulation, they don’t follow normal standards that firms use when booking transactions in their systems. To remedy this problem, EMIR REFIT is introducing a split format for the direction fields. Rather than a simple buyer/seller designation, the direction field properties will depend on the type of product being traded.

As per the table below from ESMA’s REFIT consultation paper, the new technical standards will now support per leg Payer/Receiver details for two leg products such as swaps, FX forwards and forward rate agreements. The amended format is also being introduced in other jurisdictions such as Australia where ASIC has included payer/receiver designations in their proposals for update standards that are set to go live in April 2024.

Read all our EMIR Preparing Post: