What are EMIR Regulation derivative reporting fees charged by Trade Repositories?

Complying with derivative reporting requirements of EMIR regulation is a dual sided expense. One side is the cost entailed of internal or external human resources needed to create and send reports. This part includes IT, compliance and legal people that coordinate what trade information is used for EMIR reports and technology used for storing and transferring of data and maintaining the continued process for sending daily reports.

The other side of expenses are reporting fees charged by Trade Repositories (TR) for processing submitted EMIR reports. Currently numbering six, these TRs are tasked with collecting, securing and making the reports available to EU financial regulators (more on trade repositories and who they are).

In this post, we review the basic cost structure for submitting directly trades to each of the six trade repositories. (Alternatively, many investment firms can reduce their per-trade costs by delegating their trades to a company like Cappitech with automation services starting at €350 per month. More about our services here and overall review of delegated reporting here).

Fixed vs Variable Charges

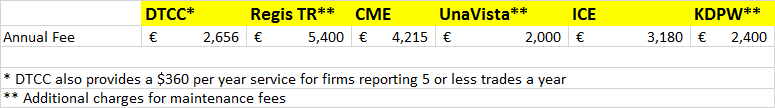

Reporting fees are composed through a calculation of fixed and variable fees. Each TR has a minimum yearly account fees. Depending on the TR, annual fees range from €2000 to €5400 (additional charges for maintenance fees may apply).

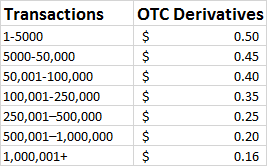

In addition to the fixed annual fee, there are variable rates that are charged on a per-trade report basis. Also, some TRs include an additional Maintenance Fee on open positions. Variable rates are typically offered using a sliding scale, of which the more you trade, the lower subsequent trades reports cost. As shown in the chart below of charges on OTC Derivative Contract reports at the DTCC, per-trade costs decrease as higher volumes of trades are submitted.

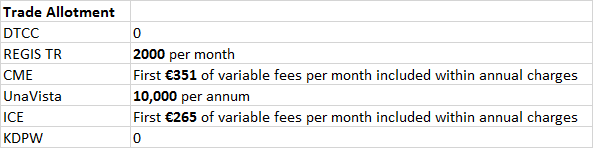

Typically, TRs provide an allotment of free trades that are included in the annual cost, before variable fees are calculated. This allotment varies per TR and types of derivatives being reported.

Fixed Fee review

The table below provides a quick summary of the fixed costs charged by each trade repository.

Along with the fixed costs, four of the TRs provide an allotment of trades that can be reported before additional variable fees are added (table below). For the CME and ICE, the various contract types are charged with different rates. As a result, rather than providing a fixed amount of free trades, they offer a credit amount which is similar to their monthly minimum fixed fee.

Variable fees and annual maximum caps

As mentioned above, each TR charges a variable fee for trades submitted to them for review. For low volume trading firms such as non-financial companies (yes they may have to report, more on that here) and asset managers, the free allotment covered by a TRs annual fee can often cover all of their report needs. But, for high volume trading companies and large fund families, the variable fees can quickly add up to hundreds of thousands of dollars.

In order to curb expenses, TRs include a maximum cap on expenses that their customers pay in annual variable fees (although maintenance fees may not be included). Below are the annual cap on charges and link to their Fee Schedules. However, firms should read the fine print of the variable fees as additional fees may be incurred for firms with multiple business units reporting or who are reporting trades on behalf of their counterparties.

• DTCC Annual Cap: €443,070* (fee schedule link)

• REGIS TR Annual Cap: €300,000 (fee schedule link)

• UnaVista Annual Cap: €200,000 (fee schedule link)

• CME Annual Cap: €263,960 (fee schedule link)

• ICE Cap: €44,500 (fee schedule link)

• KDPW Annual Cap: €60,00 (fee schedule link)

*DTCC figure is converted from stated rate of $500,000

*CME figure is converted from stated rate of £200,000

Featured image source Charles Clegg (Flickr)